Managing personal finances can be overwhelming, but tools like Copilot and Mint make it easier. Both platforms offer unique features to help users budget, track expenses, and achieve financial goals. However, choosing the right one depends on your needs, preferences, and financial habits. In this blog post, we’ll compare Copilot vs Mint in detail, exploring their features, pros, cons, and ideal use cases. By the end, you’ll know which tool is the best fit for your financial journey. Let’s dive in!

What is Copilot?

Copilot is a modern personal finance app designed to simplify money management. It offers a sleek interface, real-time expense tracking, and AI-driven insights. Unlike traditional budgeting tools, Copilot focuses on providing a personalized experience. It syncs with your bank accounts, credit cards, and investment portfolios to give you a comprehensive view of your finances.

One standout feature is its ability to categorize transactions automatically. This saves time and ensures accuracy. Additionally, Copilot provides detailed spending reports, helping users identify trends and make informed decisions. According to a 2022 survey by Fintech Times, 78% of users reported improved financial habits after using AI-driven budgeting tools like Copilot.

However, Copilot is only available on iOS and macOS, limiting its accessibility. It also comes with a subscription fee, which may deter some users. Despite these drawbacks, Copilot is a powerful tool for tech-savvy individuals seeking a modern approach to money management. For those interested in advanced AI-driven tools, pairing Copilot with an AI Detector Pro solution could further enhance financial insights and decision-making.

What is Mint?

Mint is one of the most popular free budgeting tools available today. Developed by Intuit, the company behind TurboTax and QuickBooks, Mint offers a wide range of features. These include expense tracking, bill reminders, credit score monitoring, and budgeting tools.

Mint’s strength lies in its accessibility. It’s available on both iOS and Android, making it a versatile choice for users across platforms. Additionally, Mint’s free model makes it an attractive option for those on a tight budget. According to a 2021 study by NerdWallet, 65% of users prefer free budgeting apps over paid alternatives.

However, Mint has its limitations. The app is ad-supported, which can be distracting for some users. It also lacks advanced features like investment tracking, which are available in Copilot. Despite these drawbacks, Mint remains a reliable choice for beginners and casual users.

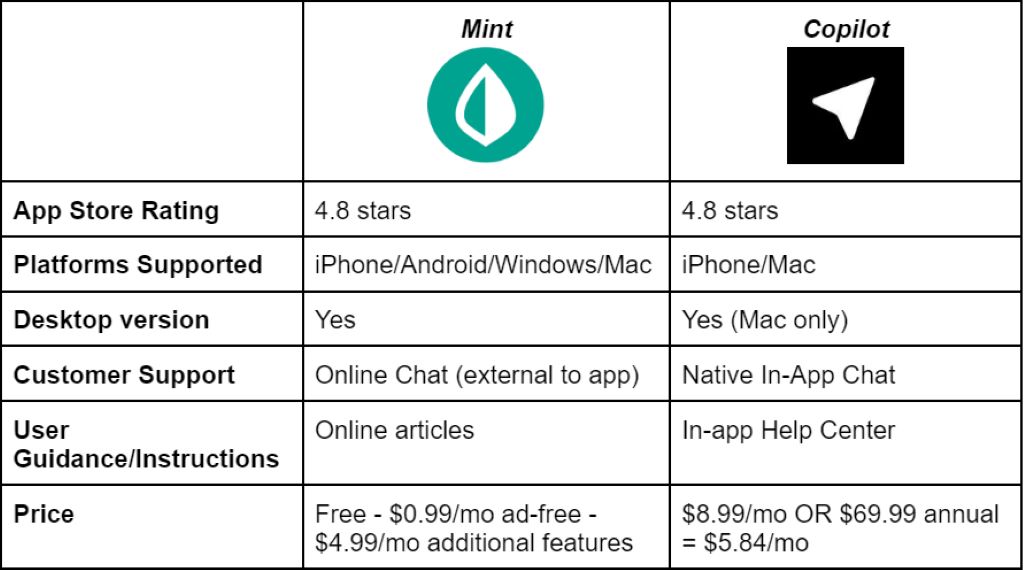

Copilot vs Mint: Key Features Compared

User Interface and Experience

Copilot’s interface is sleek, intuitive, and visually appealing. It uses charts, graphs, and color-coded categories to present financial data in an easy-to-understand format. This makes it ideal for users who prefer a modern, design-focused experience.

Mint, on the other hand, has a more traditional interface. While functional, it can feel cluttered due to ads and multiple features competing for attention. However, Mint’s simplicity makes it accessible to users of all ages and tech skill levels.

Budgeting Tools

Both Copilot and Mint offer robust budgeting tools. Copilot uses AI to create personalized budgets based on your spending habits. It also provides real-time updates, ensuring you stay on track.

Mint takes a more manual approach. Users set budget limits for each category, and the app sends alerts when they’re close to exceeding them. While effective, this method requires more effort compared to Copilot’s automated system.

Investment Tracking

Copilot excels in investment tracking. It syncs with brokerage accounts to provide real-time updates on your portfolio’s performance. This feature is particularly useful for investors who want to monitor their assets in one place.

Mint, however, lacks advanced investment tracking. While it shows basic account balances, it doesn’t provide detailed insights or performance metrics. This makes it less suitable for serious investors.

Pricing

Copilot operates on a subscription model, costing 8.99permonthor70 annually. While this may seem steep, many users find the advanced features worth the price.

Mint is completely free, making it an attractive option for budget-conscious users. However, the ad-supported model can be a downside for some.

Pros and Cons of Copilot

Pros

- Sleek, user-friendly interface

- AI-driven insights and personalized budgets

- Advanced investment tracking

- Real-time expense tracking

Cons

- Only available on iOS and macOS

- Subscription fee may deter some users

Pros and Cons of Mint

Pros

- Free to use

- Available on both iOS and Android

- Comprehensive budgeting tools

- Credit score monitoring

Cons

- Ad-supported interface

- Lacks advanced investment tracking

Who Should Use Copilot?

Copilot is ideal for tech-savvy individuals who value design and advanced features. If you’re an investor or someone who wants detailed insights into your finances, Copilot is the better choice. However, it’s best suited for Apple users due to its limited platform availability.

Who Should Use Mint?

Mint is perfect for beginners and casual users. If you’re looking for a free, easy-to-use tool to manage your budget and track expenses, Mint is a great option. It’s also a better choice for Android users or those who prefer a no-cost solution.

Tips for Choosing the Right Tool

- Assess your financial goals. If you need advanced features, go for Copilot. For basic budgeting, choose Mint.

- Consider your budget. Copilot’s subscription fee may not be suitable for everyone.

- Check platform compatibility. Copilot is limited to Apple devices, while Mint works on both iOS and Android.

- Test both apps. Many platforms offer free trials or demos to help you decide.

Conclusion

Choosing between Copilot and Mint depends on your unique needs and preferences. Copilot offers a modern, feature-rich experience but comes at a cost. Mint, on the other hand, is free and accessible but lacks advanced features. By evaluating your financial goals and priorities, you can select the tool that best aligns with your lifestyle.

We’d love to hear your thoughts! Which tool do you prefer, and why? Leave a comment below, share this article with friends, or explore our related content for more insights.

FAQs

What is the main difference between Copilot and Mint?

Copilot offers advanced features like AI-driven insights and investment tracking, while Mint focuses on basic budgeting and expense tracking.

Is Copilot worth the subscription fee?

If you value advanced features and a sleek interface, Copilot is worth the cost. However, casual users may prefer Mint’s free model.

Can I use Mint on an iPhone?

Yes, Mint is available on both iOS and Android devices.

Does Copilot support Android devices?

No, Copilot is currently only available on iOS and macOS.

Which tool is better for investment tracking?

Copilot is better for investment tracking, as it provides detailed insights and real-time updates on your portfolio.