If you’re looking for a hassle-free way to send and receive money, pay bills, or even invest, Cash App might be just what you need. But if you’re new to the platform, you might be wondering, “How do I use Cash App?” Fear not, because in this guide, we’ll walk you through everything you need to know to get started with Cash App and make the most out of its features.

Getting Started with Cash App

First things first, you’ll need to download the Cash App mobile application from the App Store (for iOS devices) or Google Play Store (for Android devices). Once downloaded, follow the prompts to sign up for an account. You’ll need to provide some basic information such as your name, email address, and phone number.

1. Linking Your Bank Account

To start using Cash App, you’ll need to link a bank account or debit card. This allows you to add funds to your Cash App account and withdraw money to your bank account when needed. Cash App uses bank-level encryption to keep your financial information safe and secure.

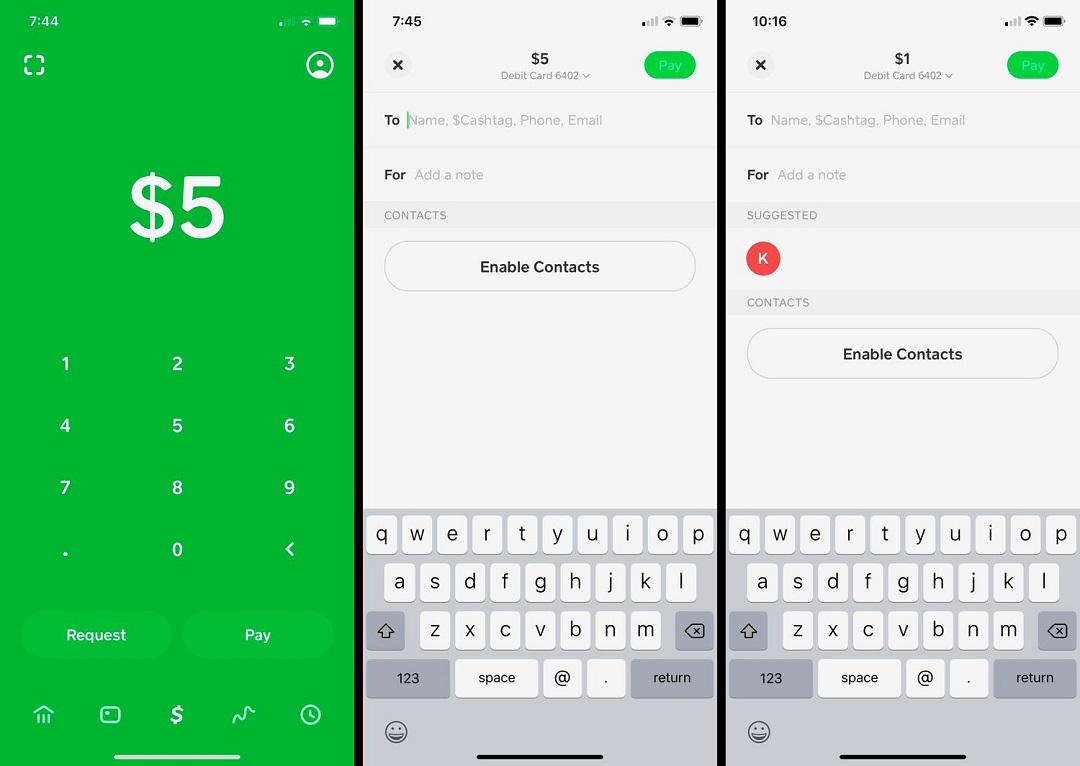

2. Sending and Receiving Money

Sending money with Cash App is as easy as typing in the amount you want to send and the recipient’s $Cashtag (a unique username associated with their Cash App account) or phone number or email address. Once sent, the money will be instantly transferred to the recipient’s Cash App account.

3. Paying Bills

Cash App also allows you to pay bills directly from the app. Simply link your utility bills or other accounts to Cash App, and you can easily pay them with just a few taps on your smartphone.

4. Investing with Cash App

For those interested in investing, Cash App offers a feature called Cash App Investing, which allows you to buy and sell stocks and Bitcoin directly from the app. You can start investing with as little as $1 and track your investments in real-time.

Tips for Using Cash App Effectively

- Enable Security Features: To keep your Cash App account secure, enable features such as Touch ID or Face ID (on supported devices), two-factor authentication, and notification alerts for account activity.

- Set Spending Limits: If you’re concerned about overspending, Cash App allows you to set daily spending limits to help you stay within your budget.

- Take Advantage of Cash Boosts: Cash Boosts are special discounts or rewards that you can apply to your purchases when using your Cash Card (Cash App’s debit card). Keep an eye out for new Boosts to save money on everyday purchases.

- Stay Informed with Cash App Blog: Cash App regularly updates its blog with tips, tricks, and news about new features. Check it out periodically to stay informed and make the most out of your Cash App experience.

FAQs

Is Cash App safe to use?

Yes, Cash App employs advanced security measures such as encryption, fraud detection, and account verification to keep your financial information safe and secure.

Can I use Cash App internationally?

While Cash App is primarily available in the United States and the United Kingdom, you may be able to use it internationally for sending and receiving money. However, currency conversion fees may apply.

How long does it take to receive money on Cash App?

In most cases, money sent to you on Cash App will be available instantly in your account. However, some transactions may take up to 1-3 business days to process, depending on your bank.

Does Cash App charge fees for transactions?

Cash App does not charge fees for sending or receiving money with a linked bank account or debit card. However, there may be fees for certain transactions, such as instant transfers or ATM withdrawals.

Can I use Cash App without a bank account?

While it’s possible to use Cash App without a bank account by receiving funds and keeping them in your Cash App balance, linking a bank account or debit card allows you to add funds and withdraw money to your bank account.

In conclusion, Cash App offers a convenient and user-friendly platform for managing your finances, sending money to friends and family, paying bills, and even investing—all from the palm of your hand.